How Housing Fares in the CARES Act

The COVID-19 Pandemic has rocked the economy, with the hardest hit being, travel, hospitality, and real estate. With 26MM unemployed and markets in a tailspin, the government has stepped up, passing a series of legislation to counteract the effects of COVID, the centerpiece of which is the CARES Act.

We thought we’d highlight the key legislation that affects real estate and affordable housing stakeholders specifically.

Mortgage Forbearance

The Federal Housing Finance Agency (FHFA) is announcing that Fannie Mae and Freddie Mac will offer multifamily property owners mortgage forbearance with the condition that they suspend all evictions for renters unable to pay rent due to the impact of coronavirus.

Affected borrowers can defer their mortgage payments for up to 180 days. Borrowers also have the right to apply for an extension of another 180 days of forbearance. There will be no penalties or fees added to the account, although regular interest will still accrue.

There is a 60 day grace period for enterprise-backed single family mortgages

Suspension of Foreclosures and Evictions

The CARES Act protects those living in various forms of public housing by providing a temporary moratorium on evictions, as well as late fees, for nonpayment of rent for 120 days beginning March 27, 2020. Landlords are not allowed to issue a notice to vacate until after the temporary moratorium period and will not be allowed to require a tenant to vacate until 30 days after the giving of the notice.

This moratorium also applies to renters in single or multi-family properties whose landlords have federally backed loans, including FHA, VA, USDA, Fannie Mae and Freddie Mac.

The Department of Housing and Urban Development (HUD) has suspended evictions and foreclosures for the next 60 days. The moratorium applies to single-family homeowners with mortgages insured by the Federal Housing Administration (FHA), a part of HUD that insures home loans made by FHA-approved lenders.

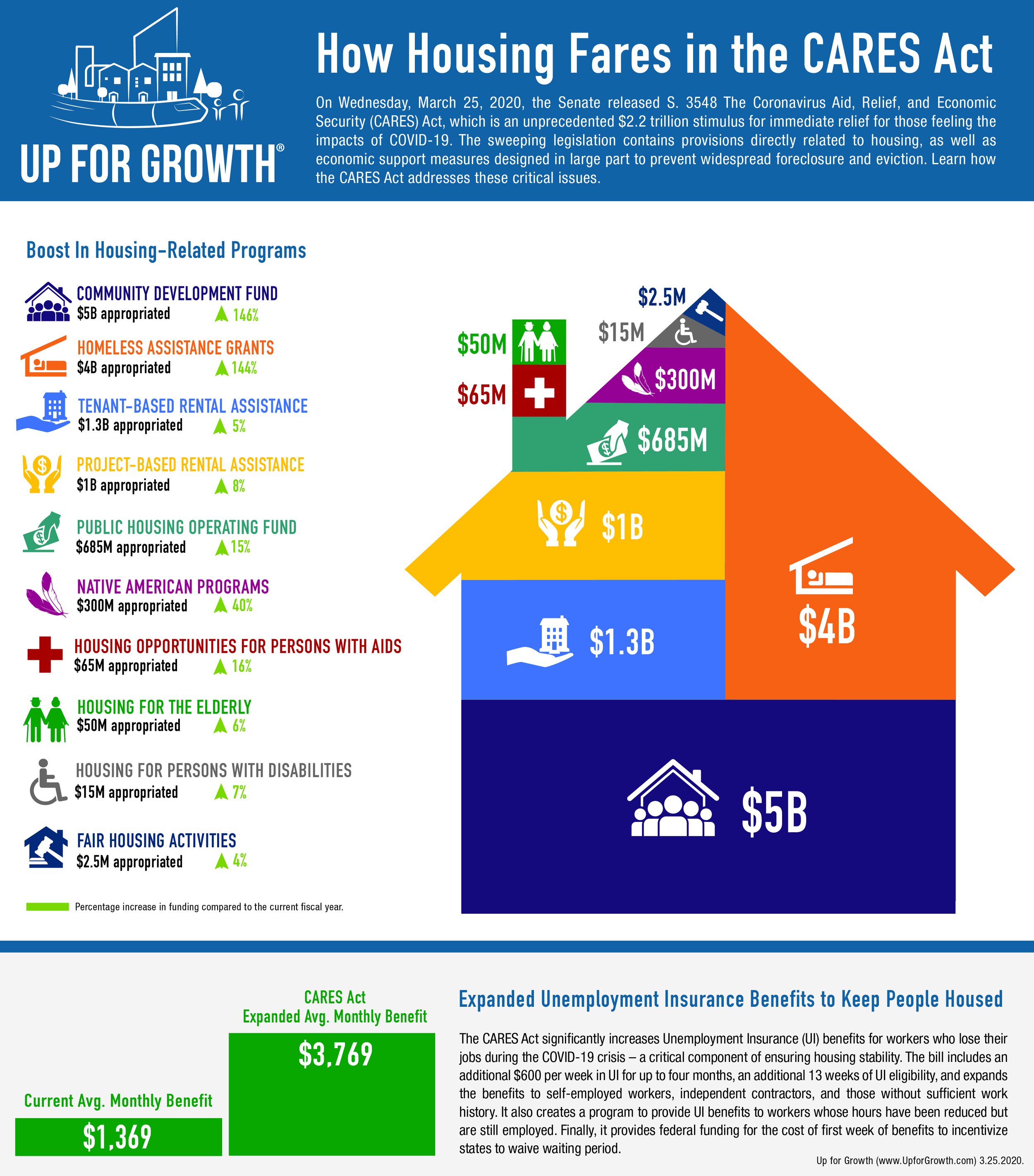

Rental Assistance Protections for Low-Income Americans

$3 billion is included for housing providers to help individuals currently assisted by HUD to safely remain in their homes or access temporary housing assistance in response to economic and housing disruptions caused by COVID-19. This funding will help low-income and working class Americans avoid evictions and minimize any impacts caused by loss of employment, and childcare, or other unforeseen circumstances related to COVID-19. This includes:

$1.935 billion to allow public housing agencies (PHAs) to keep over 3.2 million Section 8 voucher and public housing households stably housed;

$1 billion to allow the continuation of housing assistance contracts with private landlords for over 1.2 million Project-Based Section 8 households;

$65 million for housing for the elderly and persons with disabilities for rental assistance, service coordinators, and support services for the more than 114,000 affordable households for the elderly and over 30,000 affordable households for low-income persons with disabilities; and

$65 million for Housing Opportunities for Persons with AIDS in order to maintain rental assistance and expand operational and administrative flexibilities for housing and supportive service providers.

Proposals to Monitor

Up for Growth Action supported expanded UI benefits as the best – and most efficient – method for ensuring that people can still make rent and mortgage payments. But these benefits are not indefinite and may take several weeks to get into the hands of the people who need it most, and do not account for the severe affordability crisis already gripping millions of American renter households. This reality means that millions of Americans will need additional support to pay their rent.

One of the proposals for which Up for Growth Action is advocating is The Emergency Rental Assistance Act of 2020, sponsored by Representative Denny Heck (D-WA). The Emergency Rental Assistance Act, or H.R. 6314, would allocate $100 billion to the Emergency Solutions Grant (ESG) program for states to administer rental assistance to people making up to 80% of area median income – a significant increase above current levels. Similar to utilizing UI benefits to get money into the hands of American people, The Emergency Rental Assistance Act relies on existing programs and infrastructure to serve an immediate need.

Subscribe to our newsletter for more insights and to stay informed on all things Affordable Housing!